1. Define the Purpose and Scope of the LMA Loan Agreement

An LMA Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It is typically used in the financial markets, particularly for syndicated loans. The agreement should clearly define the following:

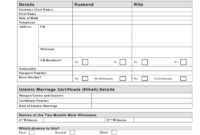

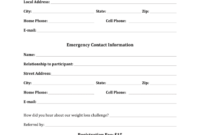

Parties Involved: The names and addresses of the lender and borrower.

2. Design Elements for Professionalism and Trust

The design of the LMA Loan Agreement template should convey professionalism and trust. Here are some key design elements to consider:

Font: Choose a clear and legible font, such as Times New Roman or Arial.

3. Content Structure and Organization

The content of the LMA Loan Agreement template should be well-structured and organized. Here is a suggested outline:

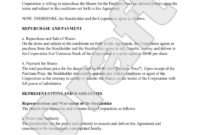

Recitals

This section should include introductory statements that provide context for the agreement.

Definitions

This section should define any terms that are used in the agreement.

Covenants

This section should outline the covenants that the borrower must comply with, such as financial Reporting requirements and restrictions on certain activities.

Events of Default

This section should specify the events that could trigger a default under the agreement.

Remedies

This section should outline the remedies that the lender may pursue in the event of a default.

Governing Law and Jurisdiction

This section should specify the governing law and jurisdiction for the agreement.

Miscellaneous

This section may include additional provisions, such as dispute resolution procedures and entire agreement clauses.

4. Legal Language and Clarity

The LMA Loan Agreement should be written in clear and concise legal language. Avoid using jargon or overly complex language that may be difficult for the parties to understand.

5. Signature Page

The signature page should be a separate page at the end of the agreement. It should include spaces for the signatures of the lender and borrower, as well as their printed names and titles.

6. Appendices

If necessary, the agreement may include appendices with additional documents, such as financial statements or schedules.